Around 7.5 million borrowers were in default before the COVID-19 pandemic and more than 50% of all student loan defaults were borrowers who attended for-profit schools.

Once the federal forbearance pause is lifted, on June 30, 2023, the average borrower will experience a 17% jump in their student loan monthly payments, according to an Equifax student loan crisis report. Additionally, the report anticipates that after the pause is lifted and delinquency and defaults will increase.

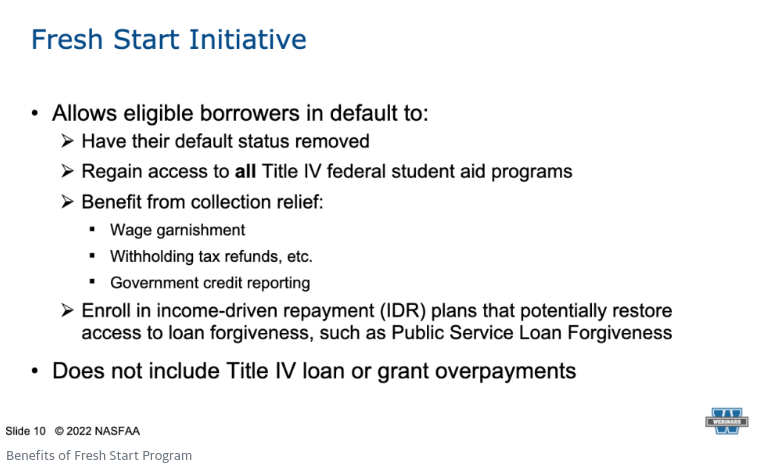

Last year, the Education Department announced the Fresh Start program to get default borrowers back into good standing once the pandemic payment pause expires.

Using Fresh Start, default borrowers can move from their default loan servicer to a regular loan servicer, making them eligible for forbearance, deferment, and income driven repayment (IDR) plans, where a monthly payment of $0 counts as payment.

Default borrowers have until December 31, 2023 to apply for Fresh Start.

Payments borrowers made on loans while in Chapter 13 bankruptcy or through wage garnishment don’t count as IDR payments for loan discharge in 20-25 years.

Although default borrowers are eligible for the one-time adjustment if they get out of default using the Fresh Start program, time in default will not be counted toward IDR.

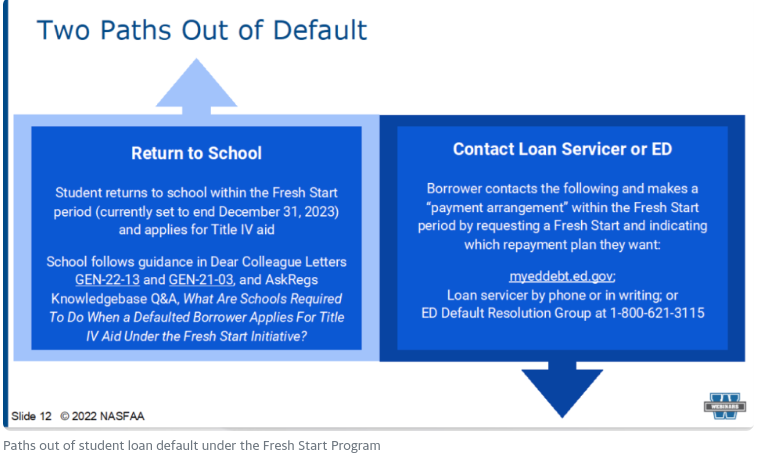

Two Paths out of Default

To get out of default, borrowers have two options. They can return to school or contact the Education Department before the December 31, 2023 deadline.

If you are returning to school, a school cannot withhold your transcripts due to your default status or any unpaid debt.

Bankruptcy and student loans

There is a general myth that student loans cannot be discharged in bankruptcy. That is not true. Much depends on whether you have federal or private student loans.

Federal student loans are held to a strict “undue financial hardship” standard that requires a separate review and hearing to be discharged in bankruptcy. There have been recent changes to bankruptcy laws for debtors with federal student loans who seek discharge under the “undue hardship” standard.

However, certain types of private student loans can be discharged like other consumer debts with a regular bankruptcy order and do not require a separate hearing, if the loans are considered “non-qualified higher education expenses.”

Private loans that are “non-qualified education expenses” that can be discharged in bankruptcy include:

- Loans for attendance at non-accredited and foreign schools ineligible for U.S. Federal student aid

- Loans given to borrowers who attended less than half-time

- Loans given over the cost of attendance, disbursed directly to the borrower, instead of the school

- Loans to cover fees, costs, studying, and living expenses for the bar exam or other professional exams

- Loans associated with the costs, fees, and living expenses for a medical or dental residency

- Other loans made for non-qualified higher education expenses

It is illegal for private loan servicers to collect on debts discharged in bankruptcy and the Consumer Financial Protection Bureau (CFPB) has ordered them to return those funds to affected borrowers.

Resources for Default Borrowers

Beware of scams. If you have federal loans, you do not pay to receive federal loan forgiveness or discharge.

| Fresh Start Program – FSA Default Group | Assistance for borrowers in default on student loans. |

| Ombudsman Group – Dept of Education | Assist borrowers in resolving student loan issues, as a last resort after trying to resolve with loan servicer or college unsuccessfully. |

| DOJ Guidance on Bankruptcy | Borrowers filing for bankruptcy have new guidelines. |

| Consumer Financial Protection Bureau (CFPB) | Tools and resources for borrowers to file complaints against institutions re: student loan debt. |