Student loan debt is considered “good debt,” but it is also the cause for an over $1.7 trillion student loan debt crisis.

Student loan debt consists of private loans and federal loans.

Over 40 million borrowers have federal student loans totaling around $1.6 trillion in debt and make up 92.7% of all student loan debt. Private student loan debt accounts for 7.61% of all student debt and totals $131.1 billion.

Unlike private loans, federal student loans are not contingent on the borrower’s credit score.

Another advantage of federal loans is the possibility of loan discharge under Teacher Loan Forgiveness (TLF), Public Service Loan Forgiveness (PSLF), or an income-driven repayment (IDR) plan after 10-25 years of repayment, depending on the plan.

Additionally, the death of a borrower results in a discharge of federal student loans. That is not the case for private loans, where the debt passes to your estate and heirs (parent or spouse).

| Federal/Direct Student Loans | Private Loans/Refinancing/Consolidation |

| Eligible for federal forbearance or loan forgiveness | Ineligible for federal forbearance or loan forgiveness |

| If you work as a public servant, your loans are discharged after 10 years of repayment under the Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness (TLF) | Not eligible for Teacher Loan Forgiveness (TLF) or Public Service Loan Forgiveness (PSLF) |

| If you die, loans are discharged | If you die, debt passes to your estate (spouse, parent, or heir) |

| After 20-25 years of repayment in an income-driven repayment (IDR) plan, remaining balance discharged | Many require payments while you are in school, but some allow you to defer payments while in school. |

Refinancing or consolidating into private loans

Some debt servicers have used Biden’s loan cancellation for up to $20,000 to promote private loan refinance options.

However, private student loans, consolidation, or refinancing makes a borrower ineligible for federal student loan debt relief, like the federal forbearance pause and loan forgiveness.

Beware of scams. If you have federal loans, you do not pay to receive federal loan forgiveness or discharge. The loan forgiveness application is only available on StudentAid.gov.

The Education Department stopped taking federal loan forgiveness applications as the case is currently before the U.S. Supreme Court.

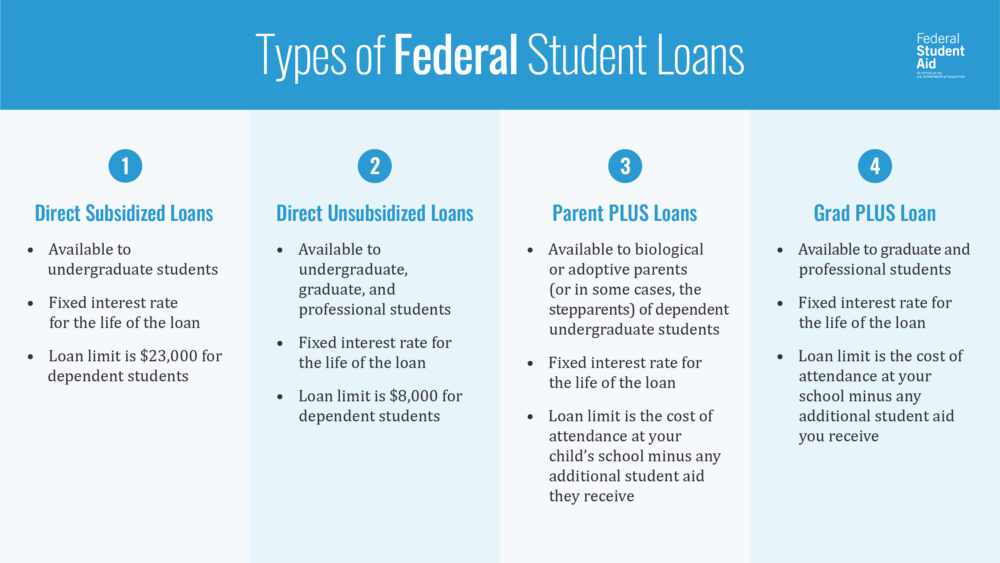

Types of Federal Loans

The type of federal student loan you get can impact whether or not you’re eligible for different types of relief.

For example, ParentPlus loans are generally excluded from income-driven repayment (IDR) plans, unless consolidated in the income-contingent repayment (ICR) plan.

Also, commercially-held Federal Family Education Loan (FFEL) and Perkins loans are typically ineligible for loan forgiveness unless consolidated.

If you’re unsure of the type of federal student loans you have, log on to the Federal Student Aid website.

Bankruptcy and student loans

There is a general myth that student loans cannot be discharged in bankruptcy. That is not true. Much depends on whether you have federal or private student loans.

Federal student loans are held to a strict “undue financial hardship” standard that requires a separate review and hearing to be discharged in bankruptcy. There have been recent changes to bankruptcy laws for debtors with federal student loans who seek discharge under the “undue hardship” standard.

However, certain types of private student loans can be discharged like other consumer debts with a regular bankruptcy order and do not require a separate hearing, if the loans are considered “non-qualified higher education expenses.”

Private loans that are “non-qualified education expenses” that can be discharged in bankruptcy include:

- Loans for attendance at non-accredited and foreign schools ineligible for U.S. Federal student aid

- Loans given to borrowers who attended less than half-time

- Loans given over the cost of attendance, disbursed directly to the borrower, instead of the school

- Loans to cover fees, costs, studying, and living expenses for the bar exam or other professional exams

- Loans associated with the costs, fees, and living expenses for a medical or dental residency

- Other loans made for non-qualified higher education expenses

It is illegal for private loan servicers to collect on debts discharged in bankruptcy and the Consumer Financial Protection Bureau (CFPB) has ordered them to return those funds to affected borrowers.