Borrowers who have been in repayment for at least 10 years and work in public service jobs with federal, state, local, or certain non-profit organizations are eligible for loan forgiveness through the Public Service Loan Forgiveness (PSLF) program.

PSLF was started in 2007 as an incentive to teachers, nurses, doctors, lawyers, and other professionals — especially in rural and urban areas.

Military service members are also eligible for PSLF if they don’t qualify for other military loan forgiveness programs like the Military College Loan Repayment Program (CLRP) or National Defense Student Loan Discharge.

More than 98% of borrowers who applied for PSLF forgiveness were denied under the former U.S. Education Secretary Betsy DeVos from the Trump Administration.

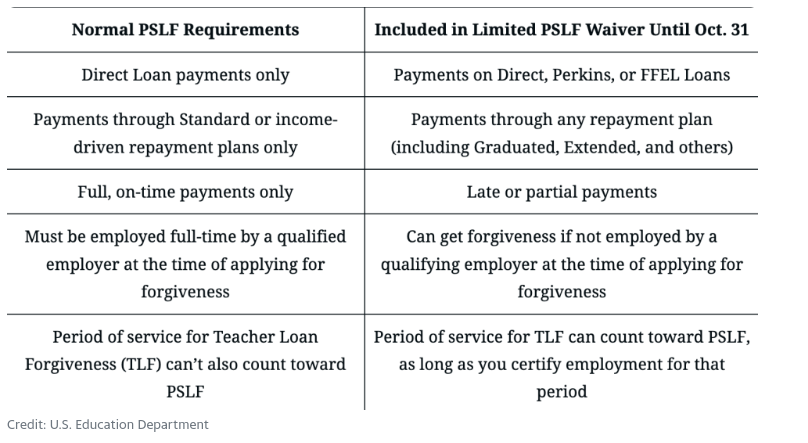

After a lawsuit from the American Federation of Teachers (AFT), the Education Department settled by instituting a waiver that expired October 31, 2022.

As of December 2022, the Department has discharged more than $21.5 billion in loans for more than 325,000 borrowers under the limited PSLF waiver.

Eligibility for PSLF doesn’t disqualify a borrower from Biden’s forgiveness of up to $20,000 in student loans, if upheld by the U.S. Supreme Court.

One-time payment adjustment

Borrowers who missed the waiver deadline will need to qualify under the normal requirements for PSLF and the Temporary Expanded Public Service Loan Forgiveness (TEPSLF).

However, borrowers may receive additional credit toward PSLF with the one-time IDR payment adjustment.

Resources

Borrowers should use the PSLF Help Tool to apply for loan forgiveness.

Beware of scams. If you have federal loans, you do not pay to receive federal loan forgiveness or discharge.

There are several organizations and advocate groups for borrowers. Below are just a few. Many work with other borrower organizations, so if they can’t assist you then can most likely point you in the right direction.

| Resources | Areas |

| Student Debt Crisis Center (SDCC) | Webinars on loan forgiveness applications, including ParentPlus and PSLF. Advocacy for borrowers. |

| Student Borrower Protection Center (SBPC) | Webinars on loan forgiveness applications, including ParentPlus and PSLF. Provides legal advocacy for borrowers’ rights. |

| The Debt Collective | A debtors’ union fighting to cancel debts and defend millions of households. |

| American Federation of Teachers (AFT) | Advocacy for educators on Teacher Loan Forgiveness (TLF) and PSLF. |

| Project on Predatory Student Lending (PPSL) | Representing students against the predatory for-profit college industry, Sweet v. Cardona. |

| National Consumer Law Center (NCLC) | Uses advocacy, education, and litigation to fight for economic justice. |

| Consumer Financial Protection Bureau (CFPB) | Tools and resources for borrowers to file complaints against institutions re: student loan debt. |

| Fresh Start Program – FSA Default Group | Assistance for borrowers in default on student loans. |

| Ombudsman Group – Dept of Education | Assist borrowers in resolving student loan issues, as a last resort after trying to resolve with loan servicer or college unsuccessfully. |

| NAACP | Advocacy for borrowers. |

| DOJ Guidance on Bankruptcy | Borrowers filing for bankruptcy have new guidelines. |

| Closed School Loan Discharge | Federal Student Aid (FSA) |

| Borrower Loan Defense Discharge | Apply on the FSA website |