Student Loans: For-profit schools

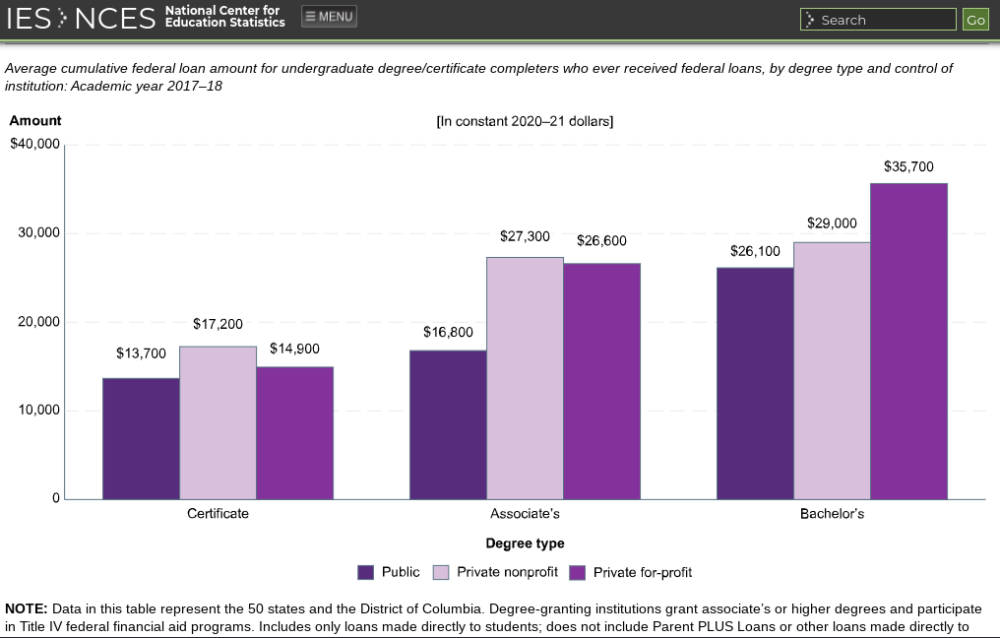

More than 70% of for-profit students borrow federal loans and account for 50% of all student loan defaults.

Students who attend for-profit colleges are three times more likely to default on student loans, and six times less likely to receive employment after enrollment, according to a 2018 NBER working paper.

For-profit schools have been called predatory and a major reason for borrowers seeking student loan discharge under the “closed school loan discharge” and “borrower loan defense discharge” programs.

Last year, the Education Department discharged $14.5 billion for nearly 1.1 million borrowers whose colleges took advantage of them under the closed school and borrower defense discharge.

When these schools close, many enrolled students are left without transferable credits or promised degrees. Military veterans tend to be targeted to take advantage of the federal funding available to them through programs like the GI Bill.

What is the difference between public, private, and for-profit schools?

Public institutions receive funding from the state and federal government and tend to be the least expensive.

Private nonprofit colleges are tax-exempt and get funding from tuition, investments, and donations. They tend to be more expensive than public colleges and universities.

| Public Colleges/Universities | Private Non-Profit Colleges/Universities | Private For-profit Schools |

| Funded by state government, includes community colleges. | Tax-exempt receiving funding from tuition, investments, and donations (ie Northwestern University, University of Chicago, New York University, Duke University). | Puts tuition revenue into people — splitting earnings among owners, investors and shareholders at the institution — rather than back into the school (ie ITT, Corinthian, Westwood, and DeVry University). |

Problematic Accreditation Status

Another issue that plagues for-profit schools is their questionable accreditation status. Accreditation helps inform students that an institution provides a quality education.

Being accredited also means that schools can accept federal funds, like the GI Bill and federal student loans for tuition.

Because 70% of for-profit students take out federal loans, it is a major revenue generator at for-profit schools.

When it comes to accreditation, some accrediting institutions are more credible than others. Additionally, some states allow schools to operate with “state approval,” but state approval is not the same as being academically accredited.

In August, the Education Department revoked the accreditation status of the Accrediting Council for Independent Colleges and Schools (ACICS) after years of scandals related to for-profit schools and the student loans debt crisis.

“ACICS accredited the worst of the worst scam schools, including Corinthian, ITT Tech and Art Institute and a school that didn’t even exist,” Thomas Gokey, an organizer with the Debt Collective, said in a statement. “These schools never should have been allowed to access federal funds, and the harm they have done to millions of students can only be repaired by full cancellation and a commitment to fund high quality public college for all.”

The Education Department is considering releasing a list of low-financial value schools. Advocates question the value of the list when these schools are still allowed to receive federal funds.

Major Lawsuits: Sweet v. Cardona and Florida HCI College

More than 100 for-profit schools are included in the Sweet v. Cardona, formally known as Sweet v. DeVos litigation.

Over 200,000 borrowers that attended the for-profit schools filed a class-action lawsuit after being denied student loan discharge under the borrower loan defense discharge.

The Project on Predatory Student Lending (PPSL) and the Housing & Economic Rights Advocates (HERA) represented the class-action borrowers. If you think you are a member of the class-action, visit the website for class members.

In December, PPSL filed a lawsuit on behalf of nursing students that attended Florida HCI College, formerly known as Health Career Institute. If you think you are impacted, reach out to PPSL.

Resources

If you believe you were defrauded by a for-profit school and have loans that you believe qualify for discharge under the “closed school loan discharge” and “borrower loan defense discharge” programs, reach out to the organizations below.

You should also reach out to your state’s attorney general.

Beware of scams. If you have federal loans, you do not pay to receive federal loan forgiveness or discharge.

There are several organizations and advocate groups for borrowers. Below are just a few. Many work with other borrower organizations, so if they can’t assist you then can most likely point you in the right direction.

| Resources | Areas |

| Student Debt Crisis Center (SDCC) | Webinars on loan forgiveness applications, including ParentPlus and PSLF. Advocacy for borrowers. |

| Student Borrower Protection Center (SBPC) | Webinars on loan forgiveness applications, including ParentPlus and PSLF. Provides legal advocacy for borrowers’ rights. |

| The Debt Collective | A debtors’ union fighting to cancel debts and defend millions of households. |

| American Federation of Teachers (AFT) | Advocacy for educators on Teacher Loan Forgiveness (TLF) and PSLF. |

| Project on Predatory Student Lending (PPSL) | Representing students against the predatory for-profit college industry, Sweet v. Cardona and Florida’s HCI College. |

| National Consumer Law Center (NCLC) | Uses advocacy, education, and litigation to fight for economic justice. |

| Consumer Financial Protection Bureau (CFPB) | Tools and resources for borrowers to file complaints against institutions re: student loan debt. |

| Fresh Start Program – FSA Default Group | Assistance for borrowers in default on student loans. |

| Ombudsman Group – Dept of Education | Assist borrowers in resolving student loan issues, as a last resort after trying to resolve with loan servicer or college unsuccessfully. |

| NAACP | Advocacy for borrowers. |

| DOJ Guidance on Bankruptcy | Borrowers filing for bankruptcy have new guidelines. |

| Closed School Loan Discharge | Federal Student Aid (FSA) |

| Borrower Loan Defense Discharge | Apply on the FSA website |